what is maryland earned income credit

If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund. 0 Comments Add a Comment.

Summary Of Eitc Letters Notices H R Block

Think of it this way.

. Did you receive a letter from the IRS about the EITC. You may qualify for the EITC even if. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current previous and upcoming tax years. Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. The local EITC reduces the amount of county tax you owe.

Millions of workers may qualify for the first time this year due to changes in their marital parental or financial status. Who Qualifies for the Earned Income Tax Credit EITC Low- to moderate-income workers with qualifying children may be eligible to claim the Earned Income Tax Credit EITC if certain qualifying rules apply to them. Claim Your Earned Income Tax Credit And Search Hundreds Of Other Deductions.

In 2019 25 million taxpayers received about 63 billion in earned income credits. The EITC is a refundable tax credit. Use the EITC tables to look up maximum credit amounts by tax year.

R allowed the bill to take effect without his signature. Ad Avoid Confusion Claim Your Earned Income Tax Credit With Our Easy Step-By-Step Process. The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years.

Find out what to do. Credit is actually money back on your tax bill. Some taxpayers may even qualify for a refundable Maryland EITC.

The local EITC reduces the amount of county tax you owe. The Earned Income Tax Credit also called the EITC is a benefit for working people with low-to-moderate income. The Earned Income Credit EIC otherwise known as Earned Income Tax Credit EITC is a valuable credit for low-income taxpayers who work and earn an income of a certain amount.

The state EITC reduces the amount of Maryland tax you owe. The state EITC reduces the amount of Maryland tax you owe. This means workers may get money back even if they owe no tax.

The Earned Income Tax Credit is a financial boost for families with low- or moderate- incomes. Ad File 1040ez Free today for a faster refund. You may claim the EITC if your income is low- to moderate.

This credit is the amount by which 25 of your federal earned income credit exceeds your maryland tax liability. Senate Bill 218 extends the tax credit to people who pay taxes using Individual Taxpayer Identification Numbers ITINs for the 2020 2021 and 2022 tax years. 15 1d To determine the annual family income eligibility of an applicant for a 16 Guaranteed Access Grant the Office or an institution of higher education that complies 17 with 183033 of this subtitle may not consider an amount received by the applicant as 18 an earned income credit under 32 of the Internal Revenue Code.

Posted What is the Maryland Earned Income Credit. The EITC is available only to. MORE SUPPORT FOR UNEMPLOYED MARYLANDERS.

What is the Maryland Earned Income Credit. It is different from a tax deduction which reduces the amount of income that your tax is calculated on. The earned-income tax credit EITC is a refundable tax credit used to supplement the wages of low-income workers and help offset the effect of Social Security taxes.

If you are unsure if you can claim the EITC use the EITC Qualification Assistant. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. The earned income tax credit EITC is a refundable tax credit designed to provide relief for low-to-moderate-income working people.

Thelocal EITC reduces the amount of county tax you owe. The bills purpose is to expand the numbers of taxpayers to whom the Earned Income Credit EIC is available and to provide for a new Maryland Child Tax Credit. Some taxpayers may even qualify for a refundable Maryland EITC.

April 26 2017 program. The Maryland earned income tax credit EITC will either reduce or eliminate. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

This article has been updated to reflect updates to the Earned Income Credit from the American Rescue Plan Act of 2021. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. 2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

Some taxpayers may even qualify for a refundable Maryland EITC. 2019 maryland earned income tax credit eitc marylands eitc is a credit for certain taxpayers who have income and have worked. March 9 2021 An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov.

In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for individuals. An expansion of marylands earned income tax credit passed quietly into law when. Ad Free tax support and direct deposit.

Expansion of the Earned Income Credit SB218 was enacted under Article II Section 17b of the Maryland Constitution. Thestate EITCreducesthe amount of Maryland tax you owe. This year the EITC is getting a second look from taxpayers because many have experienced income changes due to COVID-19.

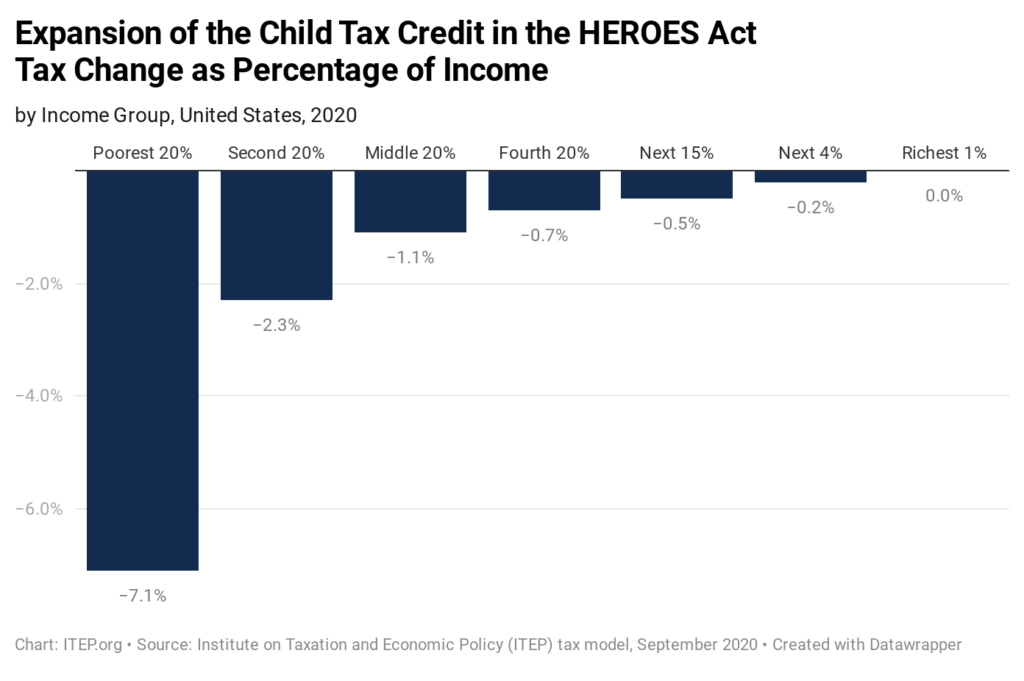

New Itep Estimates On Biden S Proposal To Expand The Child Tax Credit Itep

How Do State Earned Income Tax Credits Work Tax Policy Center

Why We Should Expand The Earned Income Tax Credit Prosperity Now

Earned Income Tax Credit Who Qualifies Changes For 2022

If You Are A Maryland Resident Maryland Resident Income Tax

Child Tax Credit Schedule 8812 H R Block

Which State Do You Belong In Based On The Life You Plan For Yourself Social Security Benefits The Motley Fool Social Security

Pin On Maryland Estate Planning

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Free Louisiana Louisiana Eic Labor Law Poster 2022

Eic Frequently Asked Questions Eic

More Top Irs Audit Triggers To Avoid Infographic Irs Audit

Tax Deductions Families Can Claim For Dependents 2020 2021 Tax Deductions Deduction Income Tax

Earned Income Credit H R Block

Earned Income Tax Credit Now Available To Seniors Without Dependents