how to calculate my paycheck in michigan

The most popular methods of earning. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

University Of Michigan Must Release Employee Salary Information After Losing Foia Lawsuit Mlive Com

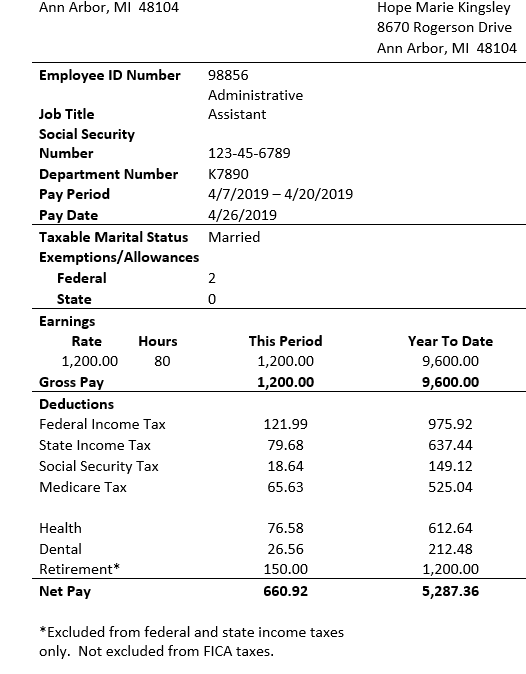

How do I calculate taxes from paycheck.

. Michigan law Michigan Vehicle Code MCL 2572174 requires dealers to apply for title and registration on behalf of their customers. For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404. Make sure to calculate any.

So you wont get a tax withholding break from supplemental wages in Michigan. Switch to Michigan hourly calculator. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis. How to Calculate Salary After Tax in Michigan in 2022 Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs Choose your filing status. If you pay salaried employees twice a month there are 24 pay periods in the year and the gross pay for one pay period is 1250 30000 divided by 24.

Lets say the annual salary is 30000. Calculates Federal FICA Medicare and withholding taxes for all 50 states. If you make 500 per week after all taxes and allowable deductions 25 of your disposable earnings is 125 500 25 125.

Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. Federal labor law requires overtime hours be paid at 15 times the normal hourly rate. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

They seem to be walking in a pattern but never do anything more than pace. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any. So naturally she became a little suspicious.

The adjusted annual salary can be calculated as. The tax calculator can be used as a simple salary calculator by entering your Weekly earnings choosing a State and clicking calculate. That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period.

Alternatively you can choose the advanced option and access. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. How to calculate taxes taken out of a paycheck.

Calculating your Michigan state income tax is similar to the steps we listed on our Federal paycheck calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. On its face that doesnt seem too weird but the woman says this has been going on for for 5 days for hours at a time.

WATCH VIDEO HERE. Figure out your filing status work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income. Enter any overtime hours you worked during the wage period you are referencing to calculate your total overtime pay.

The maximum amount that can be garnished from your weekly paycheck is 125 since the lesser amount prevails. Switch to Michigan salary calculator. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

30 8 260 - 25 56400. Gross wages represent the amount of money an employee has earned during the most recent pay period. Estimate your paycheck withholding with TurboTaxs free W-4 Withholding Calculator.

In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same flat rate of 425. Federal Payroll Taxes. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Total annual income Tax liability All deductions Withholdings Your annual paycheck. In Michigan overtime hours are any hours over 40 worked in a single week. Updates for Withholding Tax January 20 2022.

This free easy to use payroll calculator will calculate your take home pay. A salaried employee is paid an annual salary. The amount by which your disposable earnings exceed 30 times 725 is 28250 500 30 725 28250.

Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator. All bi-weekly semi-monthly monthly and quarterly figures are derived from these annual calculations. Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W-4.

Michigan Overtime Wage Calculator. The filing status affects the Federal and State tax tables. Due to a printing issue the Notice of Filing Frequency Change letters were issued with a Notice Date of September 30 instead of October 30.

In the distance in the thick of the trees you can see a figure pacing back and forth. By seeing how all of your taxes are split up and where each of them go you have a better understanding of why you pay the tax you do where the money goes and why each tax has a. Multiply the number of hours worked by the employees hourly pay rate.

Filing guidance for state copies of W-2s and 1099s has been updated. This differs from some states which tax supplemental wages at a different rate. Supports hourly salary income and multiple pay frequencies.

Need help calculating paychecks. How Your Paycheck Works. For instance a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next months rent and expenses by using their take-home-paycheck amount.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Michigan. Our Michigan Salary Tax Calculator has only one goal to provide you with a transparent financial situation. Figures entered into Your Annual Income Salary should be the before-tax amount and the result shown in Final Paycheck is the after-tax amount including deductions.

How You Can Affect Your Michigan Paycheck. This is great for comparing salaries reviewing how much extra you will have after a pay rise or simply keeping a quick eye on your tax withholdings. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator.

Michigan Tax Return Form Mi 1040 Can Be Efiled For 2021

Michigan Income Tax Calculator Smartasset

For The Federal And State Taxes The Retirement Is Chegg Com

State Of Michigan Taxes H R Block

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

U M University Of Michigan Arm Eps Pdf University Of Michigan Logo University Of Michigan University

Michigan Wage Calculator Minimum Wage Org

Michigan Sales Tax Calculator Reverse Sales Dremployee

7 06 02 Reporting Employees Who Are New To Mpsers

Michigan Paycheck Calculator Updated For 2022

Michigan State Taxes 2022 Tax Season Forbes Advisor

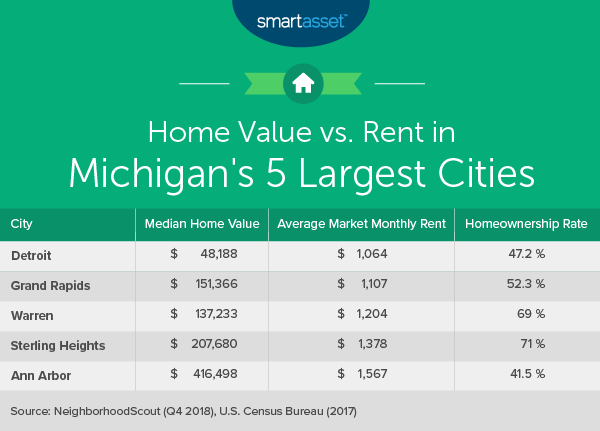

The Cost Of Living In Michigan Smartasset

Michigan Salary Calculator 2022 Icalculator

Successaesthetics Bullet Journal Inspiration Bullet Journal Journal Inspiration